If you’re an investor keeping an eye on the National Stock Exchange (NSE), there’s some exciting news on the horizon. NSE has announced a 4:1 bonus share issue, and they’ve set November 2nd as the record date. This means that for every one share you hold, you’ll receive four additional shares. This move has certainly piqued the interest of investors and market watchers alike. But what does this mean for you, and how can you make the most of it? Let’s dive in.

Understanding Bonus Shares and Their Impact

Bonus shares are free additional shares given to existing shareholders based on the number of shares they already own. In the case of a 4:1 bonus share issue, for every share you currently hold, you’ll receive four extra shares. This effectively increases the total number of shares you own without any additional cost.

How Does a Bonus Share Issue Affect NSE Share Price?

When a company issues bonus shares, the overall value of the company’s stock doesn’t change; however, the share price is adjusted accordingly. For instance, with a 4:1 bonus issue, the NSE share price will likely drop to one-fifth of its original value because the number of shares in circulation has increased by five times. However, while the share price decreases, the overall value of your holdings remains the same.

NSE Share Price Today and Market Reactions

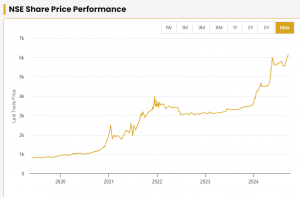

As investors anticipate the bonus share issue, the NSE share price today might see some fluctuations. It’s common for the market to react to such announcements, with prices often rising in anticipation of the record date. However, it’s important to note that the actual impact on the share price will depend on various factors, including overall market conditions and investor sentiment.

NSE Unlisted Share Price and the Private Market

For those interested in the NSE unlisted share price, it’s worth noting that unlisted shares of NSE have been quite popular among investors even before the bonus share announcement. These shares are traded in the Private market, where demand and supply can drive prices. The NSE Private market price often provides a sneak peek into how the market perceives the future prospects of a company. With the bonus issue announcement, the Private market activity around NSE unlisted shares is expected to increase, potentially affecting prices.

Why NSE’s Bonus Share Issue Matters

The 4:1 bonus share issue by NSE is a strategic move that aims to reward shareholders and enhance liquidity in the market. By increasing the number of shares, NSE makes its stock more affordable to a broader base of investors. This can lead to increased trading activity, thereby improving liquidity. Additionally, it’s a way for the company to convey confidence in its future prospects, which can be reassuring for investors.

How to Make the Most of This Bonus Share Issue

If you’re already holding NSE shares, there’s nothing you need to do to receive the bonus shares. They will be credited to your demat account automatically after the record date. However, if you’re considering buying NSE shares to benefit from this bonus issue, you need to do so before the ex-bonus date, which is usually one or two days before the record date.

The Role of Wealth Wisdom India Pvt Ltd

Navigating the complexities of the stock market, especially with unlisted shares, can be daunting. This is where Wealth Wisdom India Pvt Ltd (WWIPL) comes into play. They specialize in providing insights and guidance on investing in unlisted shares, including those of NSE. Here’s how WWIPL can help:

Expert Advice: Wealth Wisdom India Pvt Ltd. offers expert advice on buying and selling unlisted shares. With their in-depth market knowledge, they can help you make informed decisions about your investments.

Seamless Transactions: Whether you’re looking to buy or sell NSE unlisted shares, Wealth Wisdom India Pvt Ltd. facilitates smooth and hassle-free transactions, ensuring you get the best prices.

Market Insights: Staying updated on the latest market trends and movements is crucial for making smart investment decisions. Wealth Wisdom India Pvt Ltd. provides regular updates and insights into the Private market and unlisted share prices, helping you stay ahead of the curve.

Portfolio Management: Wealth Wisdom India Pvt Ltd. can also assist in managing your investment portfolio, helping you diversify and maximize returns.

The NSE’s decision to issue bonus shares at a 4:1 ratio with a record date set for November 2nd is an exciting opportunity for investors. This move is expected to make NSE shares more accessible and boost liquidity in the market. If you’re looking to invest or need guidance on navigating the unlisted shares market, Wealth Wisdom India Pvt Ltd (WWIPL) is there to help with their expertise and seamless transaction services.

FAQs

What is the significance of the record date for the bonus share issue?

The record date is crucial because it determines which shareholders are eligible to receive the bonus shares. To be eligible, you must own the shares before this date.

How will the NSE share price be affected by the 4:1 bonus issue?

After the bonus issue, the NSE share price is expected to adjust downward to reflect the increased number of shares in circulation. However, the total value of your holdings remains unchanged.

How can I buy NSE unlisted shares?

You can buy NSE unlisted shares through intermediaries like Wealth Wisdom India Pvt Ltd, who facilitate such transactions in the Private market.

What is the Private market, and how does it affect NSE unlisted share prices?

The Private market is an unofficial market where unlisted shares are traded before they are officially listed on the stock exchange. It often provides an indication of investor sentiment and demand for the shares.

How can Wealth Wisdom India Pvt Ltd. help with my investment in NSE shares?

Wealth Wisdom India Pvt Ltd. offers expert advice, seamless transaction services, market insights, and portfolio management assistance to help you make informed investment decisions in NSE shares, including unlisted ones.