Investing in unlisted shares is becoming an increasingly popular option among investors looking to diversify their portfolios and seek higher returns. Unlisted shares refer to the stocks of companies that are not listed on any stock exchange. One such prominent player in this space is Tata Capital Limited, a part of the Tata Group, which offers unlisted shares to investors. Understanding how Tata Capital unlisted share price compares to that of its competitors is crucial for anyone considering investing in this area.

In this blog, we will provide a comprehensive analysis of Tata Capital unlisted share price, its performance, and how it stacks up against competitors in the unlisted market. We will also delve into factors that affect the unlisted share prices and provide insights to help you make an informed investment decision.

What Are Unlisted Shares?

Unlisted shares are stocks that are not publicly traded on the stock exchange, which means they don’t have daily price movements like listed shares. These shares are usually offered by companies that are either in their early stages or prefer to stay private for strategic reasons.

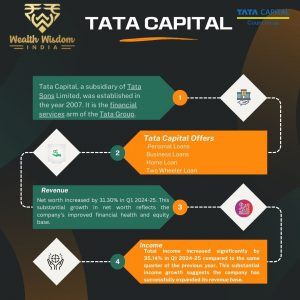

Tata Capital Limited, a leading financial services company, offers unlisted shares that have gained interest due to its strong brand and financial stability.

Tata Capital Unlisted Share Price Overview

Tata Capital unlisted share price represents a significant opportunity for investors interested in gaining exposure to a reputed financial services company. One of the factors that make Tata Capital shares attractive is its stable financial performance and reputation, backed by the globally recognized Tata Group.

Performance Insights

The performance of Tata capital share price is largely driven by the overall growth of the financial services sector, market demand for unlisted shares, and the performance of its listed peers. Investors often view Tata Capital as a reliable investment due to its consistent track record, which adds to the demand for its unlisted shares.

Key Competitors in the Unlisted Space

Tata Capital isn’t the only company offering unlisted shares in the financial sector. Competitors include prominent players such as:

HDFC Securities: Known for its leadership in the financial services space, HDFC Securities offers unlisted shares that often attract similar investors. Their unlisted shares typically trade in a similar range to Tata capital.

Reliance Retail: Though not directly comparable as it operates in retail, Reliance Retail is another popular unlisted company investors consider when looking to invest in unlisted shares of reputed firms.

Comparative Analysis of Unlisted Share Prices

Tata Capital vs HDFC Securities

HDFC Securities, like Tata Capital, operates in the financial services industry. While both companies have strong brand reputations, The difference in pricing can be attributed to the fact that HDFC Securities is a well-established name in stock broking and financial services, with a focus on retail investors. Tata Capital, on the other hand, focuses more on corporate and retail lending.

Tata Capital vs Reliance Retail

Reliance Retail stands out in the unlisted market because of its dominance in the retail sector. Its unlisted share price is significantly higher. Investors may prefer Tata capital shares if they are looking for exposure specifically in the financial services industry, rather than retail.

Factors Influencing Tata Capital Share Price

Several factors contribute to the fluctuations in Tata Capital share price now and in the future:

Financial Performance: Tata capital profitability and revenue growth significantly impact its unlisted share price. Positive quarterly results often drive demand for its shares.

Market Demand for Unlisted Shares: The overall market sentiment around unlisted shares can also affect Tata capital share price. Increased interest in unlisted companies drives prices higher.

Economic Environment: The overall economic climate, particularly in the financial services sector, influences the performance of unlisted shares. A strong economy typically leads to an appreciation in Tata capital unlisted share price.

Why Tata Capital Stands Out

Tata capital affiliation with the Tata Group is one of its biggest selling points. The Tata brand itself is synonymous with trust, stability, and growth. This makes Tata Capital an attractive choice for investors who are looking for relatively safer unlisted shares with strong growth potential.

Additionally, Tata capital diversified business model across retail, infrastructure, and commercial lending provides a balanced investment opportunity, making it a strong contender when compared to other players in the unlisted market.

Conclusion

When comparing Tata capital unlisted share price to its competitors, it becomes evident that Tata Capital offers a compelling investment case, especially for those interested in the financial services sector. While companies like HDFC Securities may offer higher share prices, Tata capital’s diverse business model and affiliation with the Tata Group make it a strong contender in the unlisted space.

FAQs

How can I buy Tata Capital unlisted shares?

You can buy Tata Capital unlisted shares through specialized platforms like Wealth Wisdom India Pvt Ltd. and also by contacting brokers that deal in unlisted securities.

Are Tata Capital unlisted shares a good investment?

Yes, due to its affiliation with the Tata Group and its consistent financial performance, Tata Capital unlisted shares are considered a good investment for those looking for exposure to the financial services sector.

How does Tata capital share price compare with competitors?

Tata Capital unlisted share price is lower than some competitors like HDFC Securities, but it stands out due to its diversified offerings and strong brand backing.

What factors influence Tata capital share price?

The financial performance of the company, overall market demand for unlisted shares, and the economic environment are key factors influencing Tata capital unlisted share price